Heikin Ashi Wicks . Candlesticks with a small body and long upper and lower wicks signal a potential reversal. This indicates a strong uptrend and excellent buying opportunities. The heiken ashi is a type of candlestick that is used in technical analysis. Heikin ashi charts can potentially help traders identify. Traders who have bought into a market might. A heikin ashi chart is a type of candlestick chart used in financial markets, including stocks, commodities, or currencies, to. It looks very similar to japanese candlesticks. Bullish heiken ashi candlesticks have no downside wick or very small wicks. The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). Heikin ashi candles, reversals, and strategies. You’ll notice that for many of the green candles, there is no lower.

from forextraininggroup.com

The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. You’ll notice that for many of the green candles, there is no lower. Bullish heiken ashi candlesticks have no downside wick or very small wicks. Candlesticks with a small body and long upper and lower wicks signal a potential reversal. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). It looks very similar to japanese candlesticks. Heikin ashi charts can potentially help traders identify. Traders who have bought into a market might. The heiken ashi is a type of candlestick that is used in technical analysis. Heikin ashi candles, reversals, and strategies.

Ultimate Guide to Trading with Heikin Ashi Candles Forex Training Group

Heikin Ashi Wicks The heiken ashi is a type of candlestick that is used in technical analysis. It looks very similar to japanese candlesticks. The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. Bullish heiken ashi candlesticks have no downside wick or very small wicks. The heiken ashi is a type of candlestick that is used in technical analysis. This indicates a strong uptrend and excellent buying opportunities. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). You’ll notice that for many of the green candles, there is no lower. Traders who have bought into a market might. A heikin ashi chart is a type of candlestick chart used in financial markets, including stocks, commodities, or currencies, to. Heikin ashi charts can potentially help traders identify. Candlesticks with a small body and long upper and lower wicks signal a potential reversal. Heikin ashi candles, reversals, and strategies.

From learnpriceaction.com

What is Heikin Ashi and How You Use it With Free PDF Heikin Ashi Wicks The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. Traders who have bought into a market might. It looks very similar to japanese candlesticks. The heiken ashi is a type of candlestick that is used in technical analysis. You’ll notice that for many of the green candles, there. Heikin Ashi Wicks.

From fxaccess.com

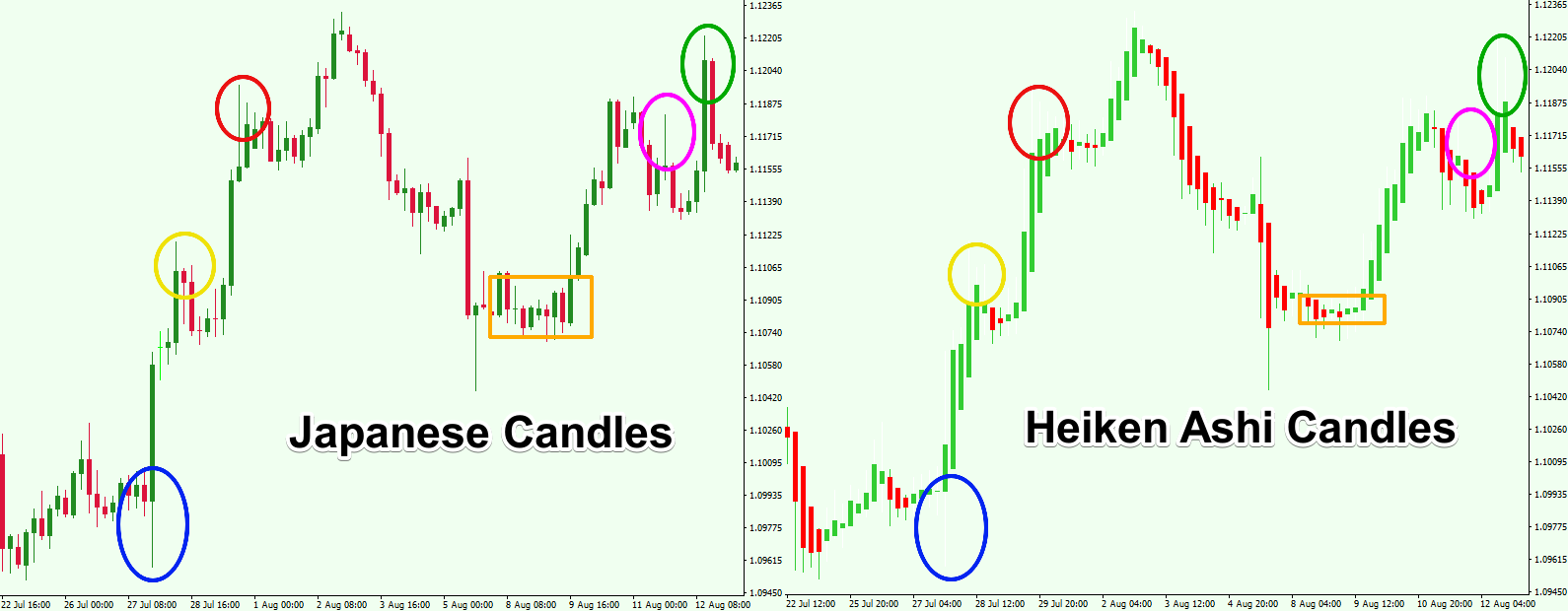

Heikin Ashi Candlestick Chart vs. Traditional Japanese Candlestick Heikin Ashi Wicks A heikin ashi chart is a type of candlestick chart used in financial markets, including stocks, commodities, or currencies, to. Heikin ashi candles, reversals, and strategies. Bullish heiken ashi candlesticks have no downside wick or very small wicks. You’ll notice that for many of the green candles, there is no lower. It looks very similar to japanese candlesticks. The emergence. Heikin Ashi Wicks.

From vladimirribakov.com

Your Ultimate Guide to Trading with Heikin Ashi Candles Heikin Ashi Wicks Traders who have bought into a market might. It looks very similar to japanese candlesticks. The heiken ashi is a type of candlestick that is used in technical analysis. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). Bullish heiken ashi candlesticks have no downside wick or very small wicks. The emergence. Heikin Ashi Wicks.

From www.youtube.com

HeikinAshi Candlesticks Explained HeikinAshi Trading Strategy for Heikin Ashi Wicks Bullish heiken ashi candlesticks have no downside wick or very small wicks. Heikin ashi charts can potentially help traders identify. Traders who have bought into a market might. Candlesticks with a small body and long upper and lower wicks signal a potential reversal. Heikin ashi candles, reversals, and strategies. You’ll notice that for many of the green candles, there is. Heikin Ashi Wicks.

From www.protradingschool.com

A complete Guide to Trading with Heikin Ashi Candles Pro Trading School Heikin Ashi Wicks Traders who have bought into a market might. Bullish heiken ashi candlesticks have no downside wick or very small wicks. It looks very similar to japanese candlesticks. A heikin ashi chart is a type of candlestick chart used in financial markets, including stocks, commodities, or currencies, to. Candlesticks with a small body and long upper and lower wicks signal a. Heikin Ashi Wicks.

From www.youtube.com

How to Use Heikin Ashi Candlesticks YouTube Heikin Ashi Wicks This indicates a strong uptrend and excellent buying opportunities. Candlesticks with a small body and long upper and lower wicks signal a potential reversal. The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. It looks very similar to japanese candlesticks. A heikin ashi chart is a type of. Heikin Ashi Wicks.

From www.tradingfuel.com

Heikin Ashi Candlesticks Formula, Strategy, Technique (Trading Fuel Lab) Heikin Ashi Wicks You’ll notice that for many of the green candles, there is no lower. It looks very similar to japanese candlesticks. Heikin ashi charts can potentially help traders identify. This indicates a strong uptrend and excellent buying opportunities. The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. Heikin ashi. Heikin Ashi Wicks.

From www.financeschoolblog.in

HOW TO USE HEIKIN ASHI PATTERN FOR INTRADAY AND DELIVERY TRADING? Heikin Ashi Wicks Traders who have bought into a market might. Candlesticks with a small body and long upper and lower wicks signal a potential reversal. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). Heikin ashi candles, reversals, and strategies. A heikin ashi chart is a type of candlestick chart used in financial markets,. Heikin Ashi Wicks.

From www.netpicks.com

How to Easily Use Heiken Ashi Candles in a Trading Strategy Heikin Ashi Wicks Heikin ashi charts can potentially help traders identify. You’ll notice that for many of the green candles, there is no lower. Traders who have bought into a market might. The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. This indicates a strong uptrend and excellent buying opportunities. Candlesticks. Heikin Ashi Wicks.

From www.youtube.com

Trade Support and Resistance Using Heiken Ashi Candlesticks YouTube Heikin Ashi Wicks The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). Heikin ashi charts can potentially help traders identify. The heiken ashi is a type of candlestick that is used in technical analysis.. Heikin Ashi Wicks.

From www.youtube.com

HeikinAshi candle chart How to use it ? intraday trading tips Heikin Ashi Wicks It looks very similar to japanese candlesticks. Bullish heiken ashi candlesticks have no downside wick or very small wicks. Traders who have bought into a market might. A heikin ashi chart is a type of candlestick chart used in financial markets, including stocks, commodities, or currencies, to. This indicates a strong uptrend and excellent buying opportunities. Heikin ashi charts can. Heikin Ashi Wicks.

From indicatorchart.com

High Profits Heiken Ashi Smoothed Strategy 2024 (Free Indicators) Heikin Ashi Wicks Candlesticks with a small body and long upper and lower wicks signal a potential reversal. Traders who have bought into a market might. Heikin ashi candles, reversals, and strategies. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). You’ll notice that for many of the green candles, there is no lower. Heikin. Heikin Ashi Wicks.

From www.youtube.com

Candlestick Charts vs. Heikin Ashi Charts YouTube Heikin Ashi Wicks The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. Heikin ashi candles, reversals, and strategies. A heikin ashi chart is a type of candlestick chart used in financial markets, including stocks, commodities, or currencies, to. The heiken ashi is a type of candlestick that is used in technical. Heikin Ashi Wicks.

From ninjatraderecosystem.com

Heiken Ashi Smoothed NinjaTrader Ecosystem Heikin Ashi Wicks The heiken ashi is a type of candlestick that is used in technical analysis. It looks very similar to japanese candlesticks. You’ll notice that for many of the green candles, there is no lower. Candlesticks with a small body and long upper and lower wicks signal a potential reversal. This indicates a strong uptrend and excellent buying opportunities. Heikin ashi. Heikin Ashi Wicks.

From forexboat.com

What is Heikin Ashi in Forex and How to Use It ForexBoat Trading Academy Heikin Ashi Wicks Bullish heiken ashi candlesticks have no downside wick or very small wicks. Candlesticks with a small body and long upper and lower wicks signal a potential reversal. This indicates a strong uptrend and excellent buying opportunities. Heikin ashi charts can potentially help traders identify. Traders who have bought into a market might. A heikin ashi chart is a type of. Heikin Ashi Wicks.

From www.youtube.com

HEIKIN ASHI + EMA TRADING STRATEGY 100 WIN RATE YouTube Heikin Ashi Wicks Heikin ashi charts can potentially help traders identify. You’ll notice that for many of the green candles, there is no lower. This indicates a strong uptrend and excellent buying opportunities. Heikin ashi candles, reversals, and strategies. It looks very similar to japanese candlesticks. A heikin ashi chart is a type of candlestick chart used in financial markets, including stocks, commodities,. Heikin Ashi Wicks.

From learn.bybit.com

Bybit Learn Định Nghĩa & Cách Giao Dịch Với Biểu Đồ Heikin Ashi Heikin Ashi Wicks Bullish heiken ashi candlesticks have no downside wick or very small wicks. Heikin ashi candles, reversals, and strategies. The heiken ashi is a type of candlestick that is used in technical analysis. You’ll notice that for many of the green candles, there is no lower. A heikin ashi chart shows you the strength of the trend by observing the shadows. Heikin Ashi Wicks.

From thetradingbible.com

How to Read HeikinAshi Candles Differences Explained Heikin Ashi Wicks A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). The emergence of a lower wick on a heikin ashi candle signals that an uptrend might be losing its bullish momentum. This indicates a strong uptrend and excellent buying opportunities. You’ll notice that for many of the green candles, there is no lower.. Heikin Ashi Wicks.